Ez itt a Zéróosztó, a G7 elemzői szeglete, amelyben külső elemzők, szakértők cikkei olvashatók. Az írások és az azokban megfogalmazott vélemények a szerzők álláspontját tükrözik.

A multi-year rally in gold and silver prices, which accelerated last October, experienced a significant correction at the end of January. Prior to that, gold and silver prices had broken through major technical levels, rising steadily since the beginning of 2024 with limited correction. Although the upward trend remains intact and both gold and especially silver are expected to continue appreciating, the era of easy money is over. One analyst still believes gold could reach a five-digit price by the end of the decade, with silver potentially rising to several hundred dollars due to underlying fundamentals.

The sharp correction in late January, which saw gold plummet from nearly $5,600 per ounce to $4,500 within days, wasn’t unexpected. The question had been how long the exponential price increase, which characterized the market since early October, could last. It was clear that increasing amounts of leveraged buying were driving up prices of precious metals, creating the potential for a swift and sharp correction.

The immediate catalyst for the decline was the appointment of Kevin Warsh as Fed Chair. The former central bank governor is known for advocating strict monetary policy between 2006 and 2011 during his tenure. Warsh also comes from the market (previously a leader at Morgan Stanley), believes in market fundamentalism, and may not be as accommodating to Trump administration policies as some feared.

This proves expected that Kevin Warsh will not alter the policy Jerome Powell has championed. If necessary, he will lower dollar interest rates, opening space for further precious metal price increases. The main factors – growing government debt, geopolitical risk, declining confidence in currencies without intrinsic value, and central bank gold purchases – will not disappear overnight.

The growing attraction to gold and silver will likely only be broken by a resurgence of globalization, a decrease in geopolitical tensions, and, most importantly, balanced budgets. Unfortunately, that doesn’t appear to be on the horizon. The Jerome Powell–Donald Trump pairing has brought about the largest gold rally in a century, and the combined activities of Kevin Warsh and Donald Trump are unlikely to reverse that trend.

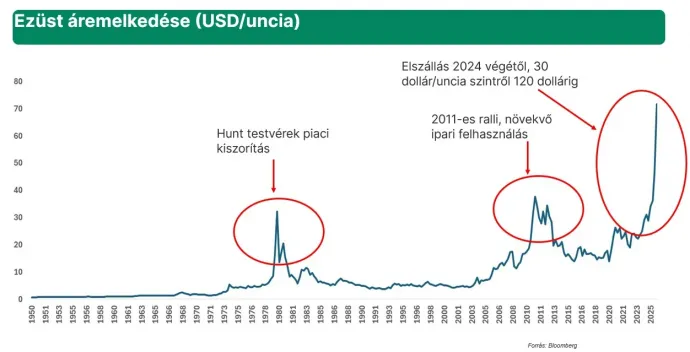

Silver’s position is even more extraordinary. Gold’s little brother is simultaneously a monetary and industrial metal.

The latter role is becoming increasingly valued due to its excellent electrical conductivity and reflectivity, and, unlike copper, silver does not corrode. It’s no surprise that the semiconductor, solar, and electronics sectors are using more and more silver. Due to industrial use, silver demand has exceeded mining and recycling supply since 2019 – the annual deficit is 100-200 million ounces. Supply is inflexible to price changes, as 80 percent of silver mining is secondary: a byproduct of copper, gold, nickel, lead, or zinc mines.

Silver’s role could grow even more significant due to its use in battery technology. Samsung is poised to initiate mass production of a latest solid-state battery in 2027 that contains 5 grams of silver per cell, as the anode material is silver-carbon, enabling rapid charging, significant range, and long life. Who wouldn’t want an electric car that fully charges in 10 minutes, has a range of 1,000 kilometers, and whose battery doesn’t lose capacity after thousands of charges?

Such a battery requires nearly a kilogram of silver for its anodes.

Samsung is estimated to purchase the entire annual global silver production if its new product covers 20 percent of the current electric vehicle market. It’s no surprise that the South Korean company has already pre-purchased the entire silver production of several producing companies (Avino Gold and Silver, Silver Storm) and is reportedly looking to buy the mining companies themselves.

Adding to the silver story is speculation that major clearinghouses, such as Comex and the Shanghai Futures Exchange, may run out of physical stock by March. Buyers – including a growing number of actual silver users – are increasingly insisting on physical delivery, as they build safety stocks while physical silver becomes harder to obtain. This could further drive up the price of the precious metal. It is likely that the physical and paper markets will become decoupled, and it is even possible that exchanges will be required to make physical delivery mandatory if they do not want to lose their role. Shortages are felt at all levels, and replacing silver with other metals – primarily copper – is a long process and not always possible.