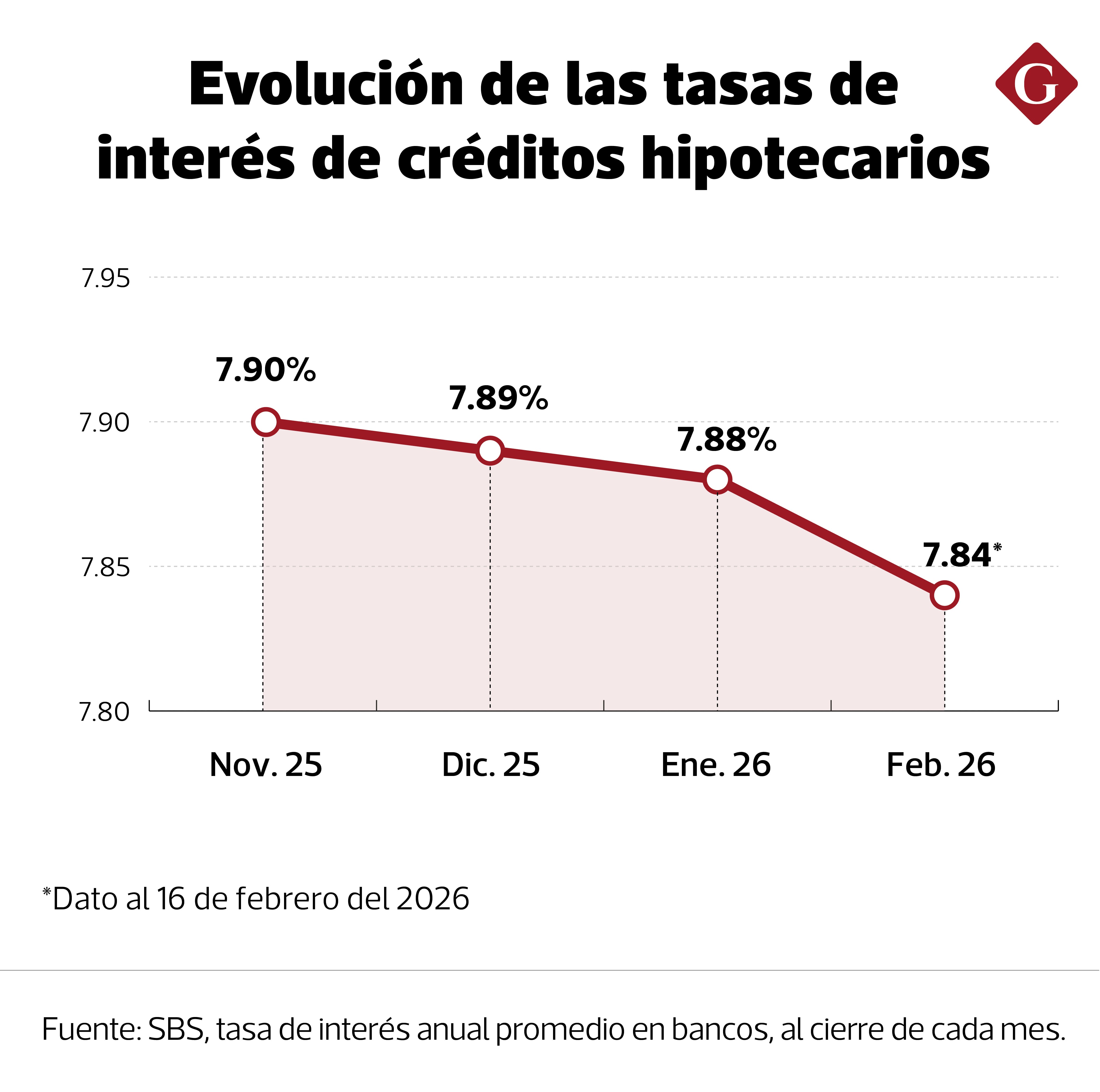

Mortgage interest rates in Peru are trending downward, averaging 7.84% annually as of February 16, 2026, according to recent data. This marks a decrease from 7.88% at the end of January, 7.89% at the end of December, and 7.90% at the end of November.

The decline in rates is driven by increased competition among financial institutions, explained Julio Cabrera, a finance professor at ISIL. “There was growth in mortgage lending in 2025 of almost 8% compared to 2024. This increased competition among financial entities, which is putting downward pressure on rates,” Cabrera noted. This trend is particularly relevant as lower rates can stimulate activity in Peru’s housing market.

Cabrera added that competition extends to the purchase of mortgage debt from other banks’ clients, “with the goal of offering those individuals other types of credit in the future.”

READ ALSO: Buying a home as a couple: what are the advantages and risks?

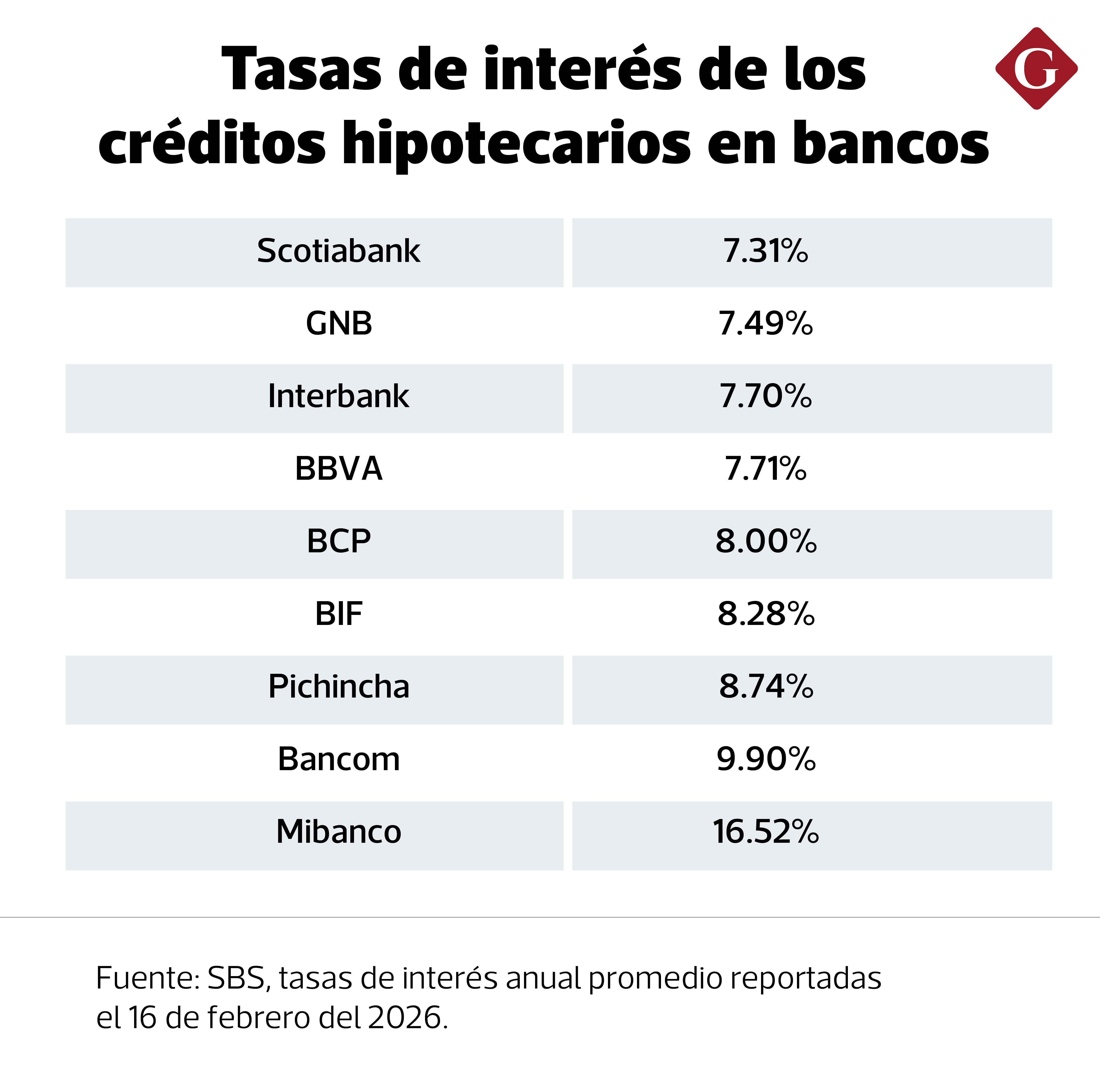

Interest rates on mortgages vary between banks, ranging from 7.31% to 16.52%.

Cost Savings with Lower Mortgage Rates

Humberto Marín, commercial director of real estate group Conforta, highlighted that mortgage interest rates have been falling in recent years, increasing the number of people who qualify for a home purchase.

“In 2023, rates averaged 10%, in 2024 they were at 9%, and 2025 closed below 8%. This represents an opportunity that benefits citizens by lowering monthly payments,” Marín emphasized.

READ ALSO: Setback for new city construction project in northern Peru, what happened?

The decrease in the interest rate results in a reduction in the amount of monthly payments, allowing more people to qualify for a mortgage.

“A one-point decrease in the interest rate on a mortgage represents a reduction of S/ 700 to S/ 800 in the monthly payment. This is a substantial amount when considering a property valued between S/ 500,000 and S/ 600,000,” said Humberto Marín.

Outlook for Mortgage Interest Rates

Julio Cabrera anticipates that the upcoming elections in Peru will have only a temporary effect on demand for mortgages, as no candidate currently leading in the polls is opposed to the market.

Cabrera predicts that interest rates will continue a slight downward trend this year and could bottom out in the range of 7.70% to 7.80% annually.