Peruvian financial institutions posted record profits in 2025, with nearly all entities reporting gains. Only one of the 47 financial entities operating in the country ended the period with a loss.

The banking sector reported combined net profits of S/ 14,147 million (approximately $3.7 billion USD) in 2025, a fresh annual high, exceeding the S/ 10,325 million (approximately $2.7 billion USD) achieved in 2024, according to statistics from the Superintendency of Banking, Insurance and AFP (SBS). This represents a 37% year-over-year increase. The strong performance underscores the resilience of the Peruvian financial system amidst broader economic trends.

LEA TAMBIÉN Qué pasa a personas con depósitos en bancos que superan los S/ 120,000

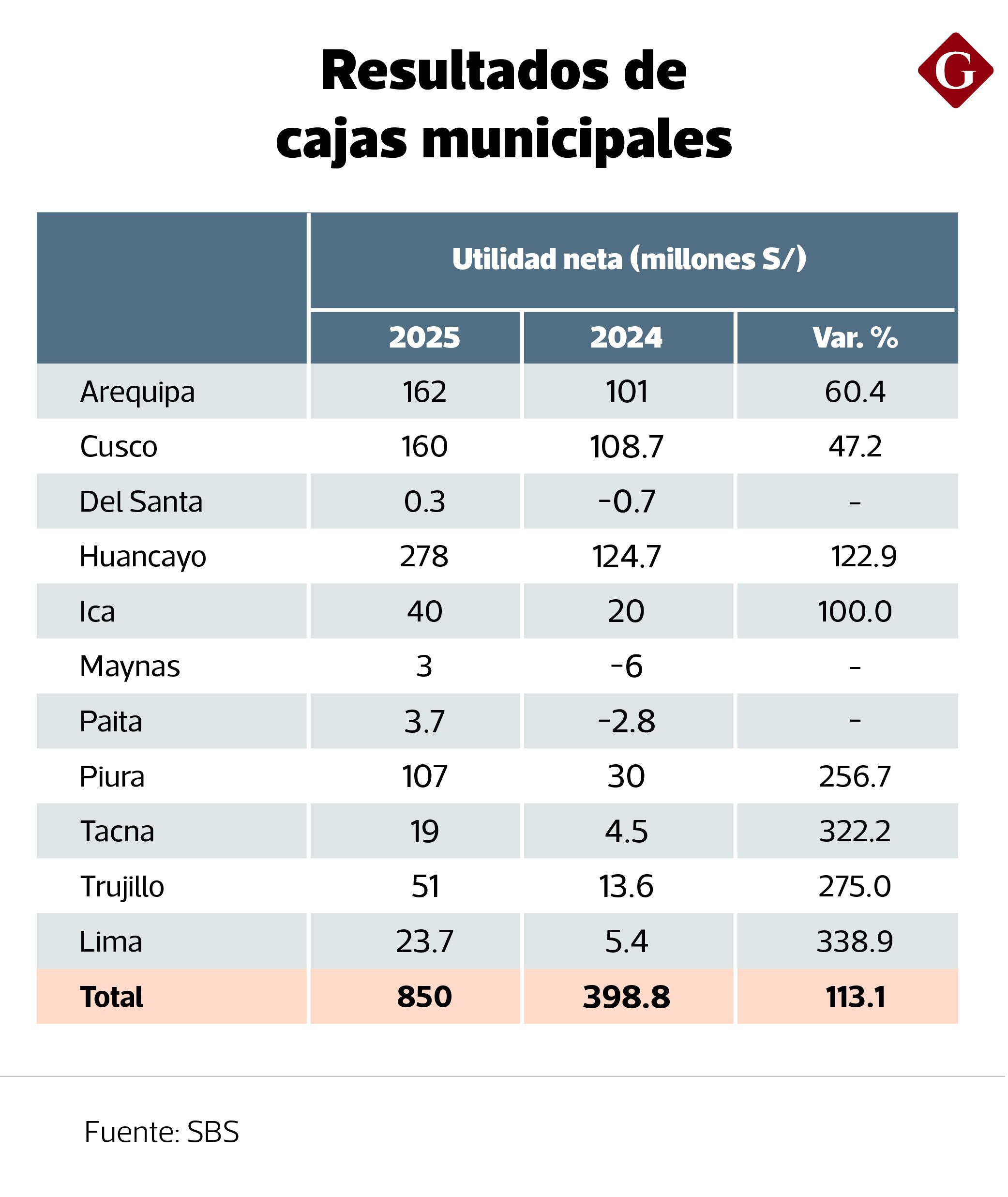

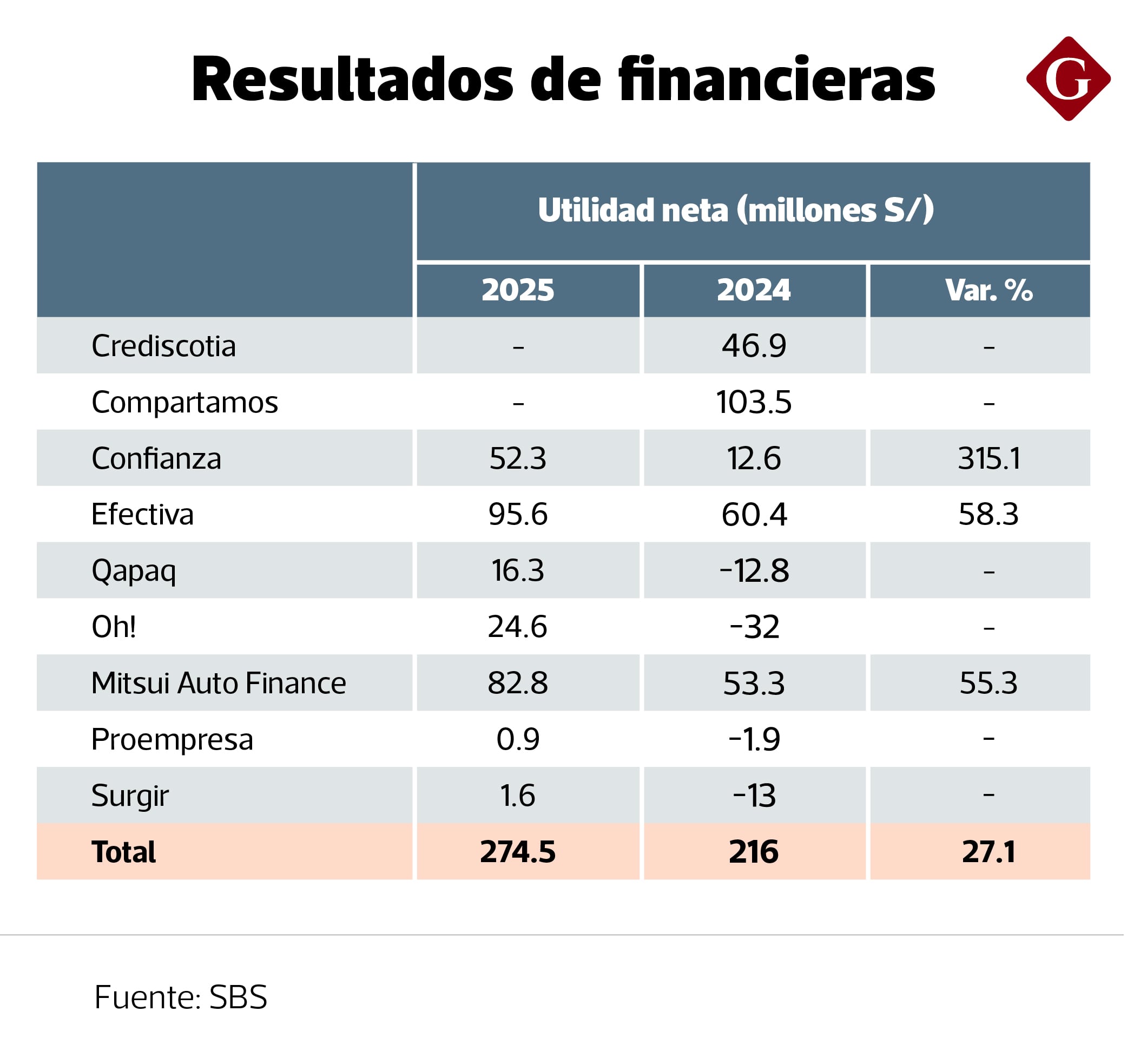

Municipal savings banks also announced net profits of S/ 850 million (approximately $223 million USD), doubling the S/ 398 million (approximately $104 million USD) from 2024 and marking a record high. Financial companies added S/ 274 million (approximately $72 million USD) in profits, with an annual expansion of 27%.

Digitalization

Peru’s economy maintained a growth trajectory in 2025, strengthening the payment capacity of individuals and businesses and marking a trend of lower non-performing loans in the financial system, according to Arturo García, director of the Lima College of Economists.

This improved performance was accompanied by significant advances in the operational efficiency of banks and municipal savings banks, driven by automation and digitalization processes, as well as the reduction of the central bank’s benchmark interest rate, which lowered funding costs for institutions. Between January and December 2025, the central bank’s rate was reduced from 4.75% to 4.25%.

In the municipal savings banks, economic growth allowed for increased income and sales for their customers, which improved the payment behavior in a context of lower funding costs, García added.

Non-Performing Loans

The evolution of non-performing loans has become one of the main reasons for the improved results of the financial system in 2025, according to Yang Chang, a professor at the University of Piura.

With a more dynamic economy, provisions for credit risk, which financial institutions must establish against potential borrower defaults, were significantly reduced, improving net results, he said. Greater economic growth is associated with better loan placement and portfolio quality, and higher profitability for lending institutions.

This positive scenario follows a year in 2024 that saw a decline in profits at 11 of 17 banks and half of microfinance institutions operating at a loss, with non-performing loans exceeding 8%.

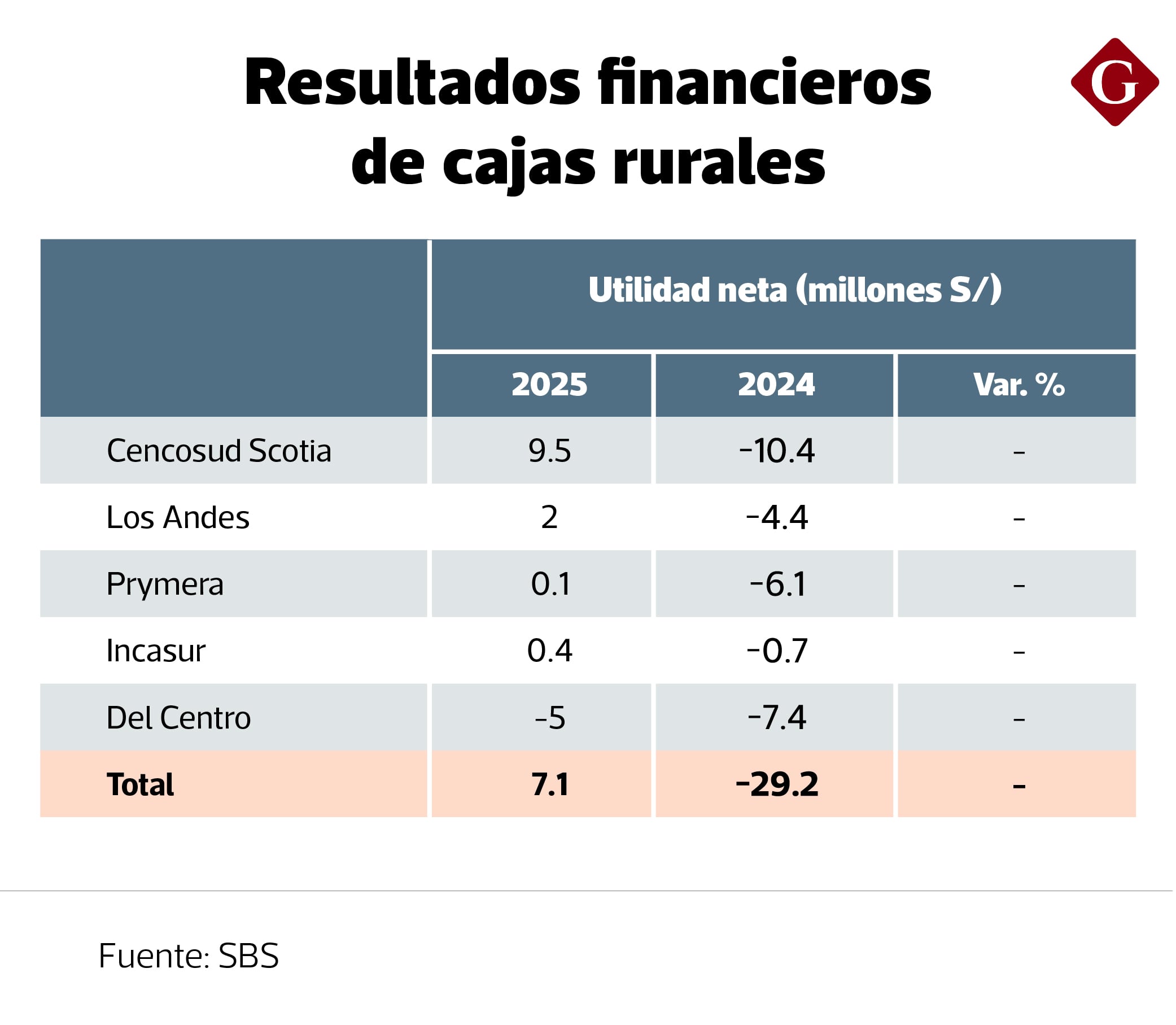

Rural banks also showed a rebound in their net profits, after five consecutive years of combined losses, totaling S/ 7.1 million in 2025. In this segment, only one bank reported losses.

Credit Companies

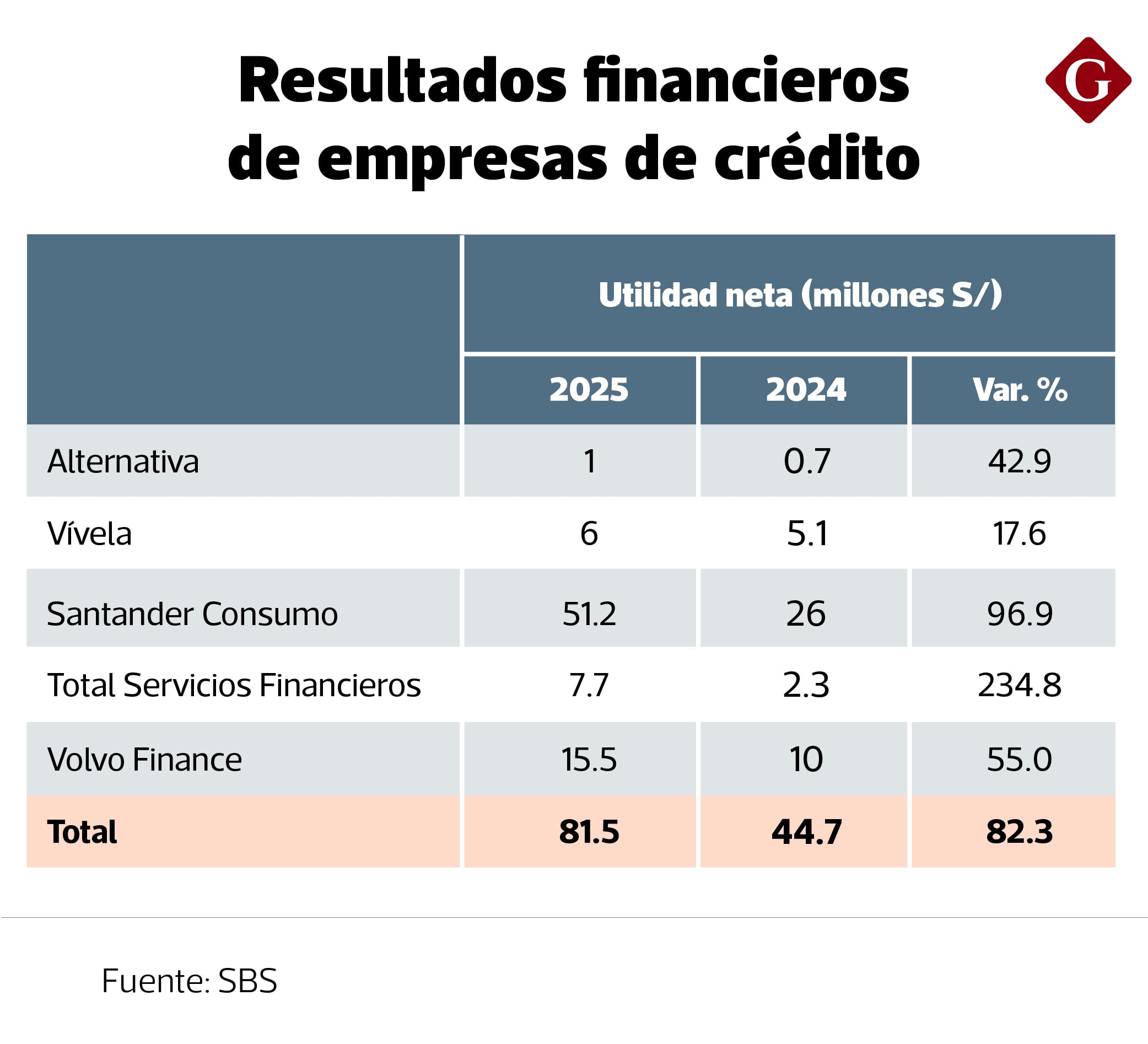

Credit companies – formerly SMEs – accumulated net profits of S/ 81 million (approximately $21 million USD), representing an annual increase of 82%.

Chang noted that rural banks faced greater difficulties in recent years due to their smaller size and structural problems in some entities that dragged down the sector average.

The decent performance of credit companies benefited from the dynamism of consumption, which grows faster when the economy advances. Their strategy of specializing in a niche market allowed for a faster recovery in their profits, he added.

Two Scenarios for 2026

Despite the context of increased crime facing the country, financial institutions achieved significant profits in 2025, analysts say. Still, 2026 brings a relevant factor that could change the trend of these results.

“It should be a good year for the financial system, but it all depends on whether the political side generates chaos. If the elections result in a disruptive mandate, it could change the credit granting policies currently followed by the banks,” commented Yang Chang.

Arturo García agrees that this year there would be two scenarios. A projected economic growth of around 3%, contained political risks, a reduction in the central bank’s rate, and a consolidation of a fall in non-performing loans would lead to good results for the banking sector. But if political noise causes social unrest, the forecasts would be less optimistic, he added.

The outlook is favorable this year, with an economy that could grow by more than 3% and inflation anchored within the target range, which would continue to support credit demand, estimated Víctor Blas, of Financiera Confianza.

LEA TAMBIÉN Bonos de Gobierno dan más rentabilidad que depósitos en bancos, ¿a quiénes les conviene?