British Pound Struggles amid Mixed UK Economic data

Table of Contents

- British Pound Struggles amid Mixed UK Economic data

- Market Reaction to UK Data

- British Pound Performance Against Major Currencies

- Global Currency Market Update: JPY Surges, GBP and CAD struggle

- Currency Market Update: CHF Shows strength Amidst Declines in NZD and Other Majors

- FAQ: British Pound Struggles amid Mixed UK Economic Data

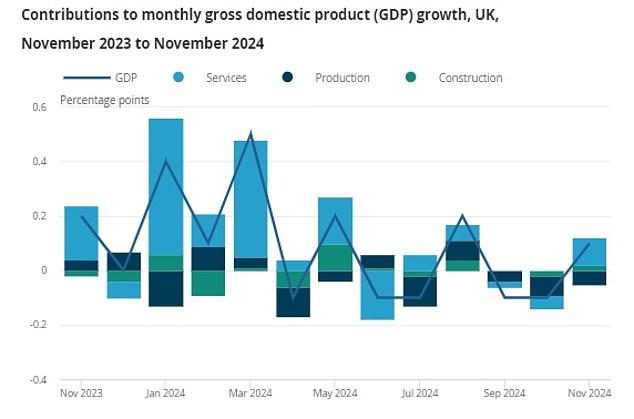

The British Pound (GBP) faced a challenging day in the currency markets, reacting to a mix of economic data from the United Kingdom. The latest figures from the Office for National Statistics (ONS) revealed that the UK economy expanded by 0.1% in November, a slight enhancement from the 0.1% contraction in October. However, this growth fell short of market expectations, which had forecasted a 0.2% increase.

in addition to the GDP data, the Index of Services for October remained flat at 0% on a three-month-on-three-month basis, compared to a 0.1% increase in the previous month.This stagnation in the services sector added to the overall cautious sentiment surrounding the UK economy.

Further compounding the economic concerns, the monthly Industrial and Manufacturing Production figures for November showed declines of 0.4% and 0.3%, respectively.These drops were unexpected and contributed to the negative market reaction.

Market Reaction to UK Data

The release of the economic data had an immediate impact on the Pound Sterling. At the time of writing, the GBP/USD pair was trading 0.29% lower on the day, hovering near the 1.2200 mark. This decline reflects the marketS disappointment with the underwhelming economic performance.

British Pound Performance Against Major Currencies

According to the latest data, the British Pound showed varying performance against major currencies. The table below highlights the percentage change of GBP against listed major currencies today:

| USD | EUR | GBP | JPY | |

|---|---|---|---|---|

| Percentage Change | -0.29% | -0.22% | 0.00% | -0.44% |

Notably, the british Pound was the weakest against the Japanese Yen, reflecting a important decline in its value. this underperformance against the Yen underscores the broader challenges facing the GBP in the current economic climate.

As the UK navigates through these economic uncertainties, market participants will closely monitor upcoming data releases and policy decisions for further indications of the country’s economic trajectory.

Global Currency Market Update: JPY Surges, GBP and CAD struggle

The global currency market has seen notable fluctuations today, with the Japanese Yen (JPY) emerging as a strong performer while the British pound (GBP) and Canadian Dollar (CAD) faced declines.

Japanese Yen (JPY) Leads the Pack

The JPY has shown significant strength across the board. It recorded gains against multiple major currencies, including:

- 0.23% against USD

- 0.29% against EUR

- 0.53% against GBP

- 0.44% against CHF

- 0.56% against CAD

- 0.45% against AUD

- 0.16% against NZD

This robust performance underscores the JPY’s resilience in the current economic climate.

British Pound (GBP) Faces broad Declines

In contrast, the GBP has struggled, posting losses against several major currencies:

- -0.31% against USD

- -0.22% against EUR

- -0.53% against CHF

- -0.08% against CAD

- -0.02% against AUD

- -0.35% against NZD

The GBP’s decline highlights ongoing challenges in the UK economy, impacting its currency’s performance.

Canadian Dollar (CAD) Under Pressure

The CAD also experienced a tough day, with losses against several currencies:

- -0.22% against USD

- -0.14% against EUR

- -0.44% against GBP

- -0.27% against NZD

Despite these declines,the CAD managed to post modest gains against the AUD and CHF,indicating some resilience.

Other Notable Movements

Other currencies also saw varied performances:

- USD gained 0.08% against EUR and 0.31% against GBP but lost 0.23% against CHF.

- EUR saw a mixed day, with a 0.22% gain against GBP but a 0.29% loss against CHF.

- AUD had a mixed performance, with a 0.08% gain against CAD but a 0.44% loss against CHF.

These movements reflect the dynamic nature of the global currency market, influenced by a myriad of economic factors and geopolitical events.

Stay tuned for more updates as the currency market continues to evolve.

Currency Market Update: CHF Shows strength Amidst Declines in NZD and Other Majors

in the latest currency market movements, the Swiss Franc (CHF) has demonstrated notable strength, while the New Zealand Dollar (NZD) and several other major currencies have experienced declines. This update provides a detailed look at the percentage changes among these currencies.

Swiss Franc (CHF) Performance

The Swiss Franc has shown positive movements against several major currencies. Key highlights include:

- 0.06% increase against an unspecified currency

- 0.13% increase against an unspecified currency

- 0.35% increase against an unspecified currency

- 0.27% increase against an unspecified currency

- 0.39% increase against an unspecified currency

- 0.33% increase against an unspecified currency

However, it did see a slight decline of 0.16% against one currency.

New Zealand Dollar (NZD) Performance

The New Zealand Dollar has faced several declines, with the following percentage changes:

- -0.29% against an unspecified currency

- -0.21% against an unspecified currency

- -0.45% against an unspecified currency

- -0.06% against an unspecified currency

- -0.33% against an unspecified currency

On a positive note, the NZD saw minor increases of 0.02% and 0.06% against two unspecified currencies.

Other Major currencies

Other major currencies have also experienced various changes:

- Declines ranging from -0.05% to -0.56% against unspecified currencies

- One currency showed a slight increase of 0.06% against an unspecified currency

Understanding the Heat Map

The heat map used in this analysis shows the percentage changes of major currencies against each other. The base currency is selected from the left column, while the quote currency is chosen from the top row. As a notable example, selecting the British pound (GBP) from the left column and moving horizontally to the US Dollar (USD) will display the percentage change for GBP/USD.

Stay tuned for more updates on currency market movements and trends.

British Pound has struggled against several major currencies today. Key declines include:

- 0.29% against USD

- 0.22% against EUR

- 0.53% against JPY

These declines highlight the market’s concerns over the UK’s current economic performance and uncertainties.

Canadian Dollar (CAD) Under Pressure

The Canadian Dollar also experienced challenges in today’s market, showing notable weaknesses, including:

- 0.56% decline against JPY

- 0.08% decline against an unspecified currency

These decreases reflect broader market trends influencing the CAD.

the global currency market continues to be influenced by various economic and geopolitical factors. Stay informed and keep an eye on further developments and data releases that could impact currency movements.

FAQ: British Pound Struggles amid Mixed UK Economic Data

Here are some frequently asked questions about the recent performance of the British Pound and its impact on the market:

- why did the British Pound decline recently?

The British Pound declined due to weaker-then-expected economic data from the UK, including minimal GDP growth and declines in industrial production, which disappointed market expectations.

- How did the UK GDP data impact the British Pound?

The GDP data showed a mere 0.1% growth in November, below the forecasted 0.2%.This lower growth rate added to the negative sentiment surrounding the GBP.

- against which currency did the GBP see the most meaningful decline?

According to recent data,the GBP saw the largest decline against the Japanese Yen (JPY),reflecting broader challenges and market sentiment towards the UK economy.

- What other economic data affected the British Pound?

Aside from GDP data, stagnant services sector growth and unexpected drops in industrial and manufacturing production have contributed to the GBP’s recent underperformance.

- How should traders respond to the GBP’s fluctuations?

Traders should monitor ongoing economic releases and policy decisions closely, as these can provide insights into potential future movement of the GBP in the currency markets.

For more updates, analyses, and market trends, keep following our latest reports and discussions. Share your thoughts and join the conversation on social media!

1 comment

[…] the US Dollar‘s Strength and Market […]