Electric vehicle charging costs in Italy remained largely stable through December, though high-powered charging stations saw a slight price reduction, according to a new report. The analysis, compiled by Adiconsum and TARIFFEV, reveals a dynamic market landscape marked by both growing competition and the exit of several charging operators. As EV adoption rises-with brands like Leapmotor seeing strong sales growth-consumer groups are pushing for greater price openness and for public charging to be classified as a utility service.

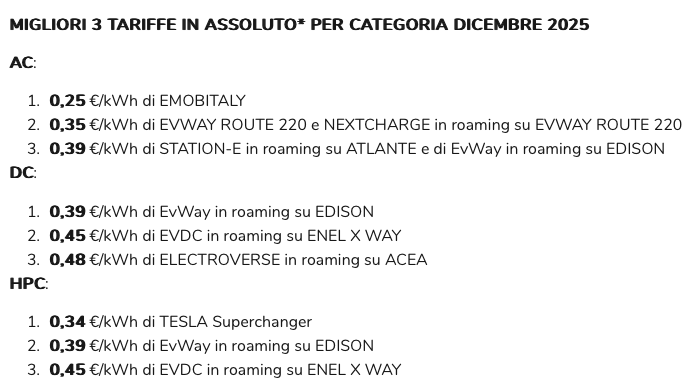

Electric vehicle charging prices remained stable in December, but a notable decrease in the cost of high-powered charging (HPC) stations offered a bright spot for EV drivers. HPC rates now average €0.75 per kilowatt-hour (kWh), aligning with the cost of direct current (DC) fast charging. This development comes as the industry aims to make EV charging more competitive with gasoline-powered vehicles, with a price point of €0.60 to €0.65 per kWh considered a key threshold.

The latest data, compiled by Adiconsum and TARIFFEV, also revealed a shifting landscape of charging providers. While several new operators entered the market – particularly in the high-power charging segment – five companies, including Acea, E.on, Shell, and Area, have ceased operations. The findings are detailed in a year-end report on 2025 charging prices. The report highlights increased competition within the sector and the expansion of charging infrastructure along highways, with companies like Atlante and Ionity leading the way.

Despite the overall stability, consumer advocacy group Adiconsum is urging for further progress. “The 2026 could bring innovation in classifying public charging as a public utility service. Promoting transparency, fairness and accessibility and a decrease in prices given the excellent sales performance,” the organization stated. Experts suggest that increased competition and network expansion are contributing to a gradual improvement in the charging experience, though challenges remain.

Looking back at 2025, the Observatory reported stable but still relatively high annual average prices. Alternating current (AC) charging averaged €0.62/kWh, while DC fast charging cost €0.73/kWh and HPC stations averaged €0.75/kWh. The charging network has grown to approximately 70,000 points, a significant increase considering the number of electric vehicles on the road. However, pricing hasn’t fully reflected declines in the national energy price (PUN), which saw cumulative drops of 15-30% compared to December 2024 across several months. This discrepancy allows charging companies to maintain higher margins as they recoup investments.

Positive trends identified by the Observatory include increased competition from both domestic and low-cost international operators, summer promotions, discounted hourly rates, and subscription models. Despite these improvements, Italy remains one of the more expensive countries in the European Union for public EV charging. Persistent issues include a lack of tariff transparency, regulatory gaps, and regional disparities, with the majority of charging points concentrated in northern Italy.